What is the Corporate Tax Rate Right Now in the UAE?

admin

- 0

Corporate Tax Rate Right Now in the UAE

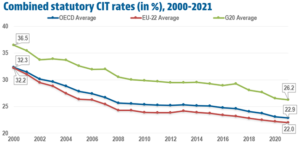

The UAE has recently changed its corporate tax rate from 0% to 9%. The government says that the new tax rate is competitive in the world, but international credit agencies are less optimistic. Moody’s, for example, has expressed concerns about the new rate. Still, the UAE’s ministry of finance says that the new tax rate is not a reason to abandon the UAE. In the UK, a 19% corporate tax rate is nearly twice as high as the UAE’s rate, and some countries don’t even charge corporate tax at all.

Corporate tax in the UAE is very competitive with other nations in the region. The country has a relatively low tax rate of just nine percent, making it a good choice for businesses. Companies in the UAE enjoy generous foreign tax credits and large deductions. The corporate tax rate in the UAE is also lower than the rates in other Arab countries, including Saudi Arabia and Egypt, which each have a corporate tax rate of more than twenty percent. In addition, small companies are exempt from corporate taxes.

Despite its low corporate tax rate, the United Arab Emirates is planning to introduce a federal corporate income tax starting January 31, 2022. This new tax rate will apply to companies that file their annual reports after June 1, 2023. Additionally, the UAE has joined the Inclusive Framework of the OECD and is implementing its anti-Base Erosion and Profit Shifting initiatives. It is also on track to introduce legislation that will implement the Global Minimum Corporate Tax of fifteen percent.

What is the Corporate Tax Rate Right Now in the UAE?

The UAE Corporate Tax rate is 9%. Businesses that make taxable profits of more than AED 375,000 must pay corporate tax. However, if you have a small business and earn less than AED 375,000, you can still avoid the tax altogether. Businesses with a taxable profit of less than AED 375,000 will continue to be taxed at the emirate level.

The proposed regime will use the accounting net profit position in the financial statements to assess taxable income. UAE businesses generally use IFRS standards for financial reporting and this will form the basis for the assessment. However, alternative financial reporting standards will also be allowed under the new law. You should consider the impact on your business and prepare accordingly.

what is the coroporate tax in the UAE

In addition, businesses that have a UAE business license will have to pay Commercial Tax. While certain industries like mining, oil and gas extraction will continue to be exempt from CT, there are still a few special cases. For instance, some free zone businesses can still take advantage of corporate tax incentives. These companies can still enjoy benefits like 0% withholding tax on domestic payments and 0% cross-border payments. Additionally, dividends and capital gains are tax-exempt if certain conditions are met. A free zone business can also transfer tax losses to other companies in the group.

The UAE CT rate is zero percent for free zone entities that transact with mainland UAE entities. However, this CT rate does not apply to passive income, such as interest, royalties, and dividends from the ownership of shares in mainland UAE companies. Additionally, this 0% CT rate also applies to mainland group companies and free zone entities. However, mainland group companies will not be able to deduct payments made to free zone entities.