How Can I Sell Carbon Credit Exchanges?

admin

- 0

Sell Carbon Credit Exchanges

Carbon credit exchanges are an increasingly popular form of carbon trading, which is often referred to as “carbon offsets”. They are purchased by businesses, individuals, and organisations and can be used to help finance carbon projects. There are a variety of factors that determine the price of a carbon credit. For example, the number of greenhouse gases released by a specific organization can affect the cost of a carbon credit.

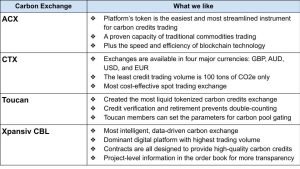

While there are several different ways to get started selling carbon credits, most buyers and sellers use carbon credit exchange platforms. These provide a safe and secure method to exchange and sell carbon credits. Companies like Carbon Trade Exchange and Brokers Carbon offer such services. The platform is a place where everyone can participate and benefit financially.

Choosing a company to sell your carbon offsets isn’t always easy. However, many financiers have brokering arms. Many of these organizations also have project development and management capabilities.

How Can I Sell Carbon Credit Exchanges?

To sell carbon credits, you must first understand how the market works. Specifically, you’ll need to know which regulations your country has in place. This can be done by researching your specific carbon market. Some countries have stricter rules on selling credits than others.

Another factor that affects the price of a carbon credit is the underlying project. Industrial projects are usually larger scale and produce large volumes of credits. On the other hand, community-based projects tend to be smaller in size. Both types of projects have to be compliant with local and national laws. Community-based projects are often more expensive to certify, but usually generate more co-benefits.

Carbon credits are usually issued in units known as allowances. An allowance is equivalent to one metric ton of carbon dioxide. If a factory has 100,000 metric tons of CO2 emissions, it needs to buy a certain amount of credits. It can then sell these allowances to other organizations for profit. Alternatively, it can simply keep them for future use.

Another way to get involved in the carbon credit exchanges is by buying shares in a specialized fund. These funds purchase an assortment of carbon contracts in order to track an index. A recent study from the Institute of International Finance predicts that the carbon market will grow to more than $100 billion per year by 2050.

Carbon trading is similar to investing in shares on the stock market. In general, it’s about buying low and selling high. By understanding the nuances of your particular market, you can ensure that you’re getting the most for your investment.

One of the biggest advantages of trading carbon credits is that you can participate in the world’s largest carbon market, the EU ETS. Countries participating in this program are required to follow strict quotas on the amount of greenhouse gas emissions they emit. If an organization exceeds the quota, it can buy more credits. Similarly, if a company wants to purchase new machinery, the expense will be subsidized by the sale of allowances.